Property Tax Report Highlights Large Inequities Created by Assessment Limits

This annual report documents the wide range of property tax rates in more than 100 US cities and helps explain why they vary so widely.

The Lincoln Institute of Land Policy, in collaboration with the Minnesota Center for Fiscal Excellence, announced the release of its newest 50-State Property Tax Comparison Study for taxes paid in 2023.

The new report estimates the effect of assessment limits that cap annual growth in the assessed value of individual properties and shows how they create large disparities in effective tax rates for owners of similarly valued homes. These limits shift the tax burden away from long-time homeowners and toward owners who recently purchased homes.

The largest disparity evidenced in the report is in Miami, where someone who just purchased a median-valued home would pay nearly three times more than someone who purchased an identical home 12 years ago—the average length of ownership there—despite both homes having an identical value in 2023. The new homeowner would pay $9,205, compared to $3,104 for the long-time owner. In six other cities a newly purchased median-valued home would face an effective tax rate at least twice as high as the rate for an equivalently valued home owned for the average duration in the city. Thirty large cities in the report have assessment limits, and the policy shifts the tax burden to new homeowners in all of them.

“The tax disparities from assessment limits are increasingly a barrier to homeownership,” said Adam H. Langley, associate director of tax policy at the Lincoln Institute. “The added property tax burden placed on new homeowners comes on top of sharp increases in mortgage costs in recent years. Assessment limits also make existing owners less likely to move if it would mean giving up tax savings accrued under those limits, which further constrains the supply of entry-level homes available for purchase and drives up prices.”

In addition to highlighting disparities created by assessment limits, this report provides the most meaningful data available to compare cities’ property taxes by calculating the effective tax rate: the tax bill as a percentage of a property’s market value. Data are available for 74 large US cities and a rural municipality in each state, with information on four different property types (homestead, commercial, industrial, and apartment properties), and statistics on both net tax bills (i.e., $3,000) and effective tax rates (i.e., 1.5 percent).

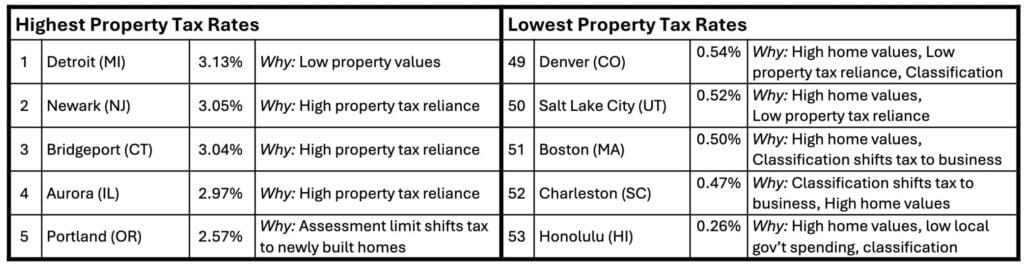

The study found that the average effective tax rate on a median-valued homestead was 1.29 percent in 2023 for the largest city in each state, with Detroit, Newark, Bridgeport (CT), and Aurora* (IL) all having effective tax rates at least twice the average. Conversely, eight cities have tax rates that are half the study average or less, led by Honolulu, Charleston (SC), Boston, Salt Lake City, and Denver. The average effective tax rate for this group of large cities fell 2.5 percent between 2022 and 2023—from 1.32 percent to 1.29 percent—and nearly twice as many cities had decreases (33) than increases (17).

Highest and Lowest Effective Property Tax Rates on a Median–Valued Home (2023)

Commercial property tax rates on office buildings and similar properties also vary significantly across cities. The effective tax rate on a $1 million commercial property averaged 1.81 percent across the largest cities in each state. The highest rates are in Detroit and Chicago, where rates are more than twice the average for this group of cities. Rates are less than half that average in Cheyenne (WY), Charlotte, Seattle, Boise, and Wilmington (DE). The average commercial tax rate for the 53 cities fell 1.5 percent between 2022 and 2023, with declines in 30 cities.

Highest and Lowest Effective Property Tax Rates on $1 Million Commercial Property

The Lincoln Institute provides more evidence on assessment limits in the Policy Focus Report on Property Tax Assessment Limits, and highlights better approaches to property tax relief in Policy Focus Reports on Property Tax Relief for Homeowners and Rethinking the Property Tax–School Funding Dilemma.

The 50-State Property Tax Comparison Study is available for download on the Lincoln Institute website.

Lead image: Residential homes in Key West, Florida. Credit: Lisa-Blue via iStock/Getty Images Plus.